The Heat Tax Part 2: Fresno vs. Phoenix – Navigating Homeownership and Energy Costs

The Heat Tax Part 2: Fresno vs. Phoenix – Navigating Homeownership and Energy Costs

Meet Ana. Ana is a first-time homebuyer working as a registered nurse with an annual income of approximately $75,000. With a fixed budget, she's carefully considering two hot-weather cities—Fresno, CA, and Phoenix, AZ—for her first home purchase. Let’s follow Ana’s journey as she weighs critical factors like utility bills, housing prices, solar energy options, and local assistance programs.

Comparing Utility Bills: Fresno vs. Phoenix

Ana quickly notices a striking difference in electricity costs between the two cities:

- Fresno (PG&E): Approximately 43¢ per kWh

- Phoenix (APS): Around 15¢ per kWh

Here’s how these rates translate into monthly expenses:

| Electricity Usage | Fresno (PG&E) | Phoenix (APS) |

|---|---|---|

| 1,000 kWh | ~$430 | ~$150 |

| 2,000 kWh | ~$860 | ~$300 |

This stark difference means significantly higher monthly bills for Ana if she chooses Fresno, directly impacting her disposable income and overall home affordability.

Housing Affordability and Income Levels

Ana further compares median home prices and household incomes:

Metric Fresno, CA Phoenix, AZ

Median Home Price ~$400,000 ~$458,000

Median Household Income ~$67,600 ~$77,000

While Fresno's homes appear initially less expensive, lower median incomes combined with significantly higher utility costs reduce the overall affordability advantage.

Housing Options: New Construction vs. Resale Homes

Ana faces the choice between new construction and resale homes:

- New Homes: Higher initial costs but typically include California's mandatory solar installations (Title 24) and energy-efficient features, lowering long-term energy expenses.

- Resale Homes: More affordable initially, but generally lack energy-efficient upgrades or solar panels. Installing solar later is an option, although recent policy shifts (NEM 3.0) mean significantly lower returns on solar energy investments.

The Impact of California’s Solar Mandate (Title 24)

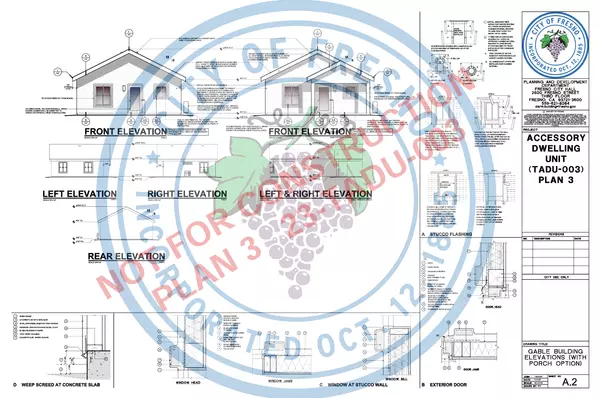

Since 2020, California’s Title 24 requires new homes to have solar panels sized to meet annual electricity usage. Though this requirement can add approximately $15,000–$20,000 to the home price, the investment quickly pays off through reduced energy bills—especially relevant given Fresno’s steep electricity rates.

Solar Ownership: Buying vs. Leasing

Ana learns the importance of solar ownership:

Buying Solar: Provides a federal tax credit (30%), enhances home equity, and maximizes long-term savings despite reduced incentives under NEM 3.0.

Leasing Solar: Low upfront costs but significantly less long-term savings, no tax benefits, and potential complications when reselling the home due to lease contract transfers.

For maximum financial benefit and home value appreciation, Ana would benefit significantly from purchasing her solar system outright or through financing.

Deep Dive into PG&E’s CARE Program

California's CARE (California Alternate Rates for Energy) program provides eligible low-income PG&E customers with a 30–35% discount on electricity bills. Eligibility criteria include:

- Income Limit: Under approximately $78,000 annually for a family of four.

- Usage Limits: Must not exceed six times Tier 1 electricity allowances.

- Metering Requirements: Only direct PG&E customers qualify, excluding many renters.

Given her income level, Ana discovers she narrowly misses eligibility. Interestingly, the CARE program often indirectly benefits real estate investors rather than aspiring homeowners. Investors who purchase properties and rent to CARE-qualified tenants make their units more attractive with discounted utility costs, while homeowners with slightly higher incomes typically see no direct benefit.

Market Realities and PG&E’s Approach

PG&E highlights CARE's impact, citing over $10 billion in total discounts provided. However, PG&E serves an economically diverse region, from affluent Bay Area communities (like Atherton, average household income exceeding $250,000) to economically challenged cities such as Fresno. This uniform policy approach often fails to adequately address specific regional needs, raising important questions about the alignment of PG&E’s assistance programs with market realities.

Impact on Mortgage Affordability

Although lenders generally don't include utility costs in debt-to-income (DTI) ratios, high energy bills can significantly reduce Ana’s disposable income. With Fresno's average monthly bill around $373 versus Phoenix's roughly $201, Ana would spend an extra $2,064 per year on utilities in Fresno. Over the life of a 30-year mortgage, this translates to over $60,000 less in disposable income—funds that could otherwise enhance her home equity or retirement savings.

Preview of The Heat Tax Part 3: Behind PG&E’s High Rates

Ana's exploration raises broader questions: why exactly are PG&E’s rates so disproportionately high? Part 3 will delve into the interplay between PG&E’s profit motives, regulatory decisions by the CPUC, and unique regional dynamics—such as employees earning Bay Area salaries while living in the lower-cost Central Valley, further complicating Fresno’s affordability crisis.

---

Sources: PG&E, APS, Zillow, EnergySage, California Public Utilities Commission (CPUC), Energy Information Administration (EIA), California Department of Housing and Community Development, U.S. Census Bureau, local economic reports.

Categories

Recent Posts

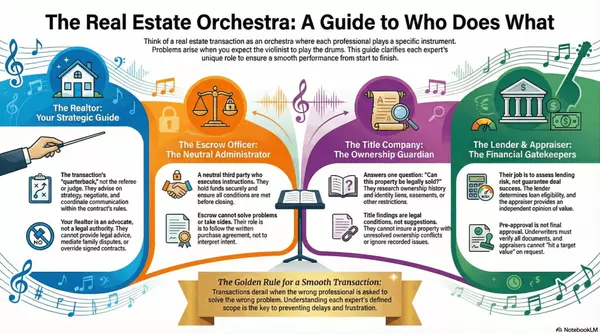

Who Does What in a California Real Estate Transaction (And What They Don’t)

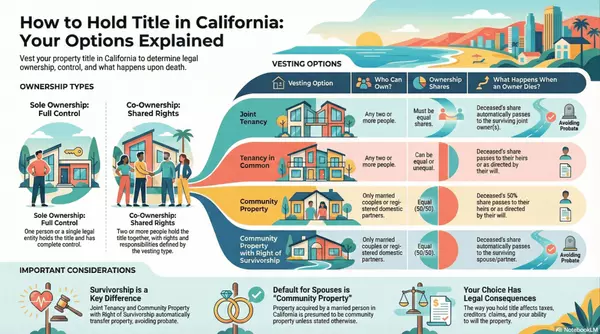

Vesting Title in Fresno: Joint Tenancy vs. Community Property Explained

So What’s Up With the New Fresno Soccer Team Announcement?

Fresno Is a Top-Five City — Time to Act Like One

90-Day Action Plan for Fresno/Clovis Sellers | All Elite Homes

90+ Benefits vs Basic Splits: How Fresno Agents Are Choosing Brokerages in 2025

Why Fresno Homeowners Have an Advantage Madera County Doesn't

Why All Elite Homes Switched to Epique – $20 More a Month, Thousands Saved

Fresno’s Summer Splashdown: Wild Water vs. The Island

Gilroy Gardens: A Whimsical Wonderland Just a Drive from Fresno

GET MORE INFORMATION