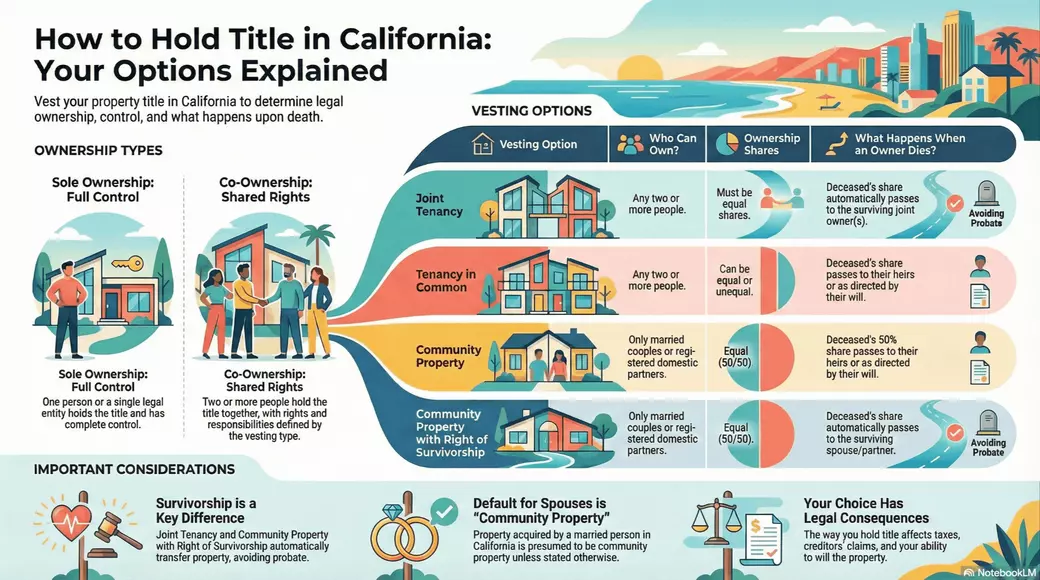

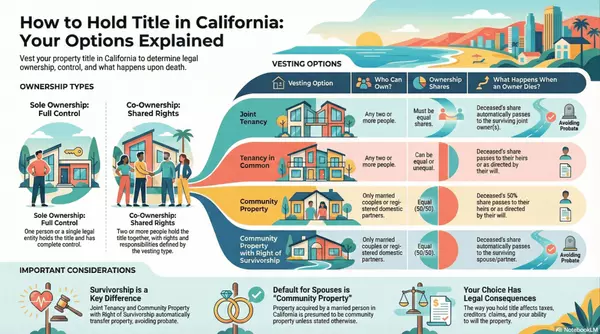

Vesting Title in Fresno: Joint Tenancy vs. Community Property Explained

Last updated for 2026 to reflect current California title and tax considerations.

Buying a home in Fresno is exciting. But one small decision—how you hold title—can quietly determine whether your spouse inherits your home smoothly or gets hit with massive capital gains taxes later.

Direct answer: Vesting refers to how you legally hold ownership of real estate. In California, vesting determines who can sign documents, who inherits the property, whether probate is required, and how much tax is owed when an owner dies.

At All Elite Homes, we see buyers focus on price, rate, and location—while vesting is treated like a checkbox. This guide explains the real consequences of that choice, especially under California’s community property laws.

The Big Three Ways Most Californians Hold Title

Direct answer: In California, most residential properties are held as Sole Ownership, Joint Tenancy, or Community Property with Right of Survivorship. Each has very different tax and inheritance outcomes.

Sole Ownership

Direct answer: Sole Ownership means one person holds 100% title to the property.

- Common for single buyers and some investors

- If married, the non-titled spouse usually signs a quitclaim deed

- Probate risk: Property usually goes through probate unless placed in a trust

In Fresno County, probate can freeze a property for a year or more.

Joint Tenancy (The Default Trap)

Direct answer: Joint Tenancy means equal ownership with a right of survivorship.

This option is commonly selected at escrow—but often without understanding the tax consequences.

The tax issue: When one owner dies, only their half receives a step-up in tax basis. The surviving owner keeps the original basis on their half.

If the home appreciated significantly, the survivor may owe large capital gains taxes upon sale.

Additional risk: Any joint tenant can sever the tenancy unilaterally, converting ownership into Tenancy in Common.

Community Property with Right of Survivorship

Direct answer: This option is available only to married couples or registered domestic partners in California.

- Avoids probate

- Automatic transfer to surviving spouse

- Full double step-up in tax basis

For many Fresno couples, this is the most tax-efficient vesting choice.

For Investors and Unmarried Buyers: Tenancy in Common

Direct answer: Tenancy in Common allows multiple owners to hold unequal shares with no survivorship rights.

- Ownership shares can be unequal

- Each share passes to heirs, not the co-owner

- Probate applies unless a trust is used

Important: If a Joint Tenant transfers their share, ownership automatically converts to Tenancy in Common.

The Gold Standard: Holding Title in a Living Trust

Direct answer: A Revocable Living Trust is often the most protective way to hold title in California.

- Avoids probate entirely

- Allows detailed inheritance planning

- Works for individuals, couples, and investors

Many high-end Fresno buyers place property into a trust shortly after closing.

Quick Comparison of California Vesting Options

| Vesting Type | Avoids Probate? | Survivorship? | Tax Benefit | Who Can Use It? |

|---|---|---|---|---|

| Sole Ownership | No | No | Limited | Anyone |

| Joint Tenancy | Yes | Yes | Partial step-up | Anyone |

| Community Property w/ ROS | Yes | Yes | Full step-up | Married couples |

| Living Trust | Yes | Optional | Flexible | Anyone |

California and Fresno-Specific Nuances

Direct answer: California is a community property state, meaning assets acquired during marriage are presumed 50/50 unless stated otherwise on title.

Fresno County requires precise deed language. Incorrect vesting wording can lead to probate or tax issues later.

Frequently Asked Questions About Title and Vesting

Can I change my vesting after I buy?

Yes. Vesting can usually be changed by recording a new deed.

Does a will override the deed?

No. The deed controls ownership. Right of survivorship generally overrides a will.

What is the Unity of Title rule?

Joint tenants must acquire ownership at the same time, with equal interest, through the same deed.

Categories

Recent Posts

GET MORE INFORMATION