Who Does What in a California Real Estate Transaction (And What They Don’t)

Last updated for 2026 to reflect current California real estate practices.

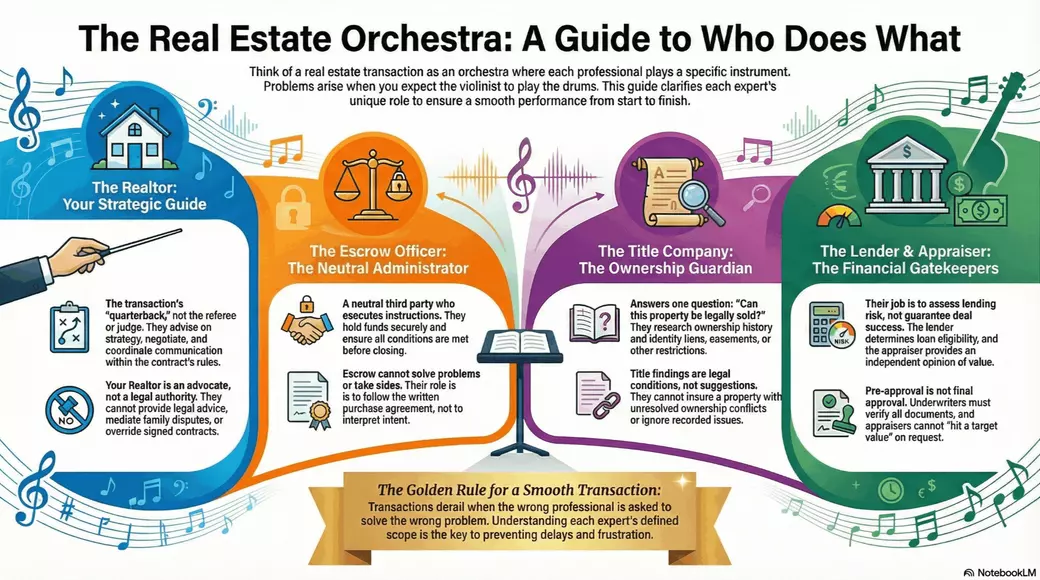

Most real estate transactions don’t fall apart because someone didn’t care. They fall apart because the wrong person is expected to solve the wrong problem.

Direct answer: A California real estate transaction involves multiple professionals, each with a clearly defined role and legal scope. When those roles are misunderstood—especially around title, ownership, and proceeds—conflict escalates and transactions stall.

At All Elite Homes, we believe clarity prevents conflict. This guide breaks down who does what, what they do not do, and why understanding these boundaries is critical to a smooth sale or purchase.

The Realtor’s Role: Advocate, Not Arbitrator

Direct answer: A Realtor’s authority exists inside the purchase contract. We advocate, coordinate, and negotiate—but we do not control title, escrow, or legal outcomes.

What your Realtor does:

- Advises on pricing, timing, and market strategy

- Drafts and negotiates purchase agreements and addenda

- Explains the transaction process in plain language

- Coordinates communication between all parties

- Tracks deadlines and protects contractual rights

What your Realtor does not do:

- Provide legal or tax advice

- Decide how multiple owners split proceeds

- Override title or escrow requirements

- Mediate family or ownership disputes into binding decisions

Key distinction: Realtors operate within the contract, not above it.

Escrow & Title: Neutral Executors, Not Decision-Makers

Direct answer: Escrow and title companies follow written instructions and recorded ownership. They do not decide fairness or resolve disputes.

Escrow Company

Escrow does:

- Hold funds and documents neutrally

- Follow the purchase contract and escrow instructions

- Coordinate signing, recording, and disbursement

Escrow does not:

- Take sides

- Interpret intent

- Pause or cancel a closing due to disagreement

Title Company

Title does:

- Verify ownership and liens

- Issue title insurance

- List requirements that must be cleared to close

Title does not:

- Fix ownership disputes

- Decide how proceeds are split

- Create estate plans

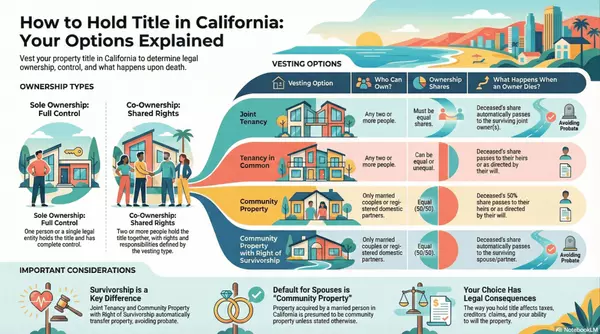

Why this matters: If ownership or vesting is unclear, neither escrow nor title can “work around it.” Those issues must be resolved separately.

For a deeper explanation of how ownership structure affects transactions, see our guide on how vesting title in Fresno impacts taxes and inheritance.

Lender, Underwriter, and Appraiser: Risk Management, Not Deal Rescue

Direct answer: The lending side of a transaction exists to manage financial risk—not to make a deal work at all costs.

Lender / Loan Officer

- Explains loan options and costs

- Collects borrower documentation

- Coordinates loan funding with escrow

Cannot: Guarantee approval or override underwriting conditions.

Loan Underwriter

- Verifies income, assets, debts, and property compliance

- Issues conditions required for funding

Cannot: Approve loans without documentation, regardless of urgency or emotion.

Appraiser

- Provides an independent opinion of value

- Analyzes market data and comparable sales

Cannot: “Hit a number” to save a deal.

Inspectors and Specialists: Information Providers, Not Decision-Makers

Direct answer: Inspectors report conditions—they do not pass or fail a property.

Home Inspector

- Evaluates visible, accessible systems

- Documents defects and safety concerns

- Recommends further evaluation when needed

Cannot: Predict hidden defects or future performance.

Termite / Pest Inspector

- Inspects for wood-destroying organisms

- Provides treatment recommendations

Cannot: Guarantee future absence of pests.

Attorneys: The Only Ones Who Can Resolve Legal Disputes

Direct answer: Only attorneys can interpret law, resolve ownership disputes, or create enforceable agreements outside the purchase contract.

Estate planning, probate issues, trust administration, and ownership conflicts fall squarely into legal territory.

This is where many transactions break down: Legal problems surface mid-transaction, but the professionals involved are not legally empowered to fix them.

Quick Reference: Who Does What (and What They Don’t)

| Role | What They Do | What They Don’t Do |

|---|---|---|

| Realtor | Negotiate, coordinate, advise | Resolve legal or ownership disputes |

| Escrow | Hold funds, execute instructions | Mediate disagreements |

| Title | Verify ownership, insure title | Decide how proceeds are split |

| Lender | Approve and fund loans | Guarantee approval |

| Attorney | Interpret law, resolve disputes | Manage daily transaction logistics |

Categories

Recent Posts

GET MORE INFORMATION